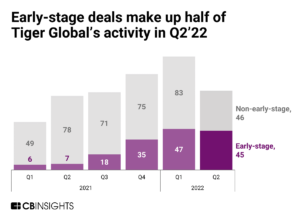

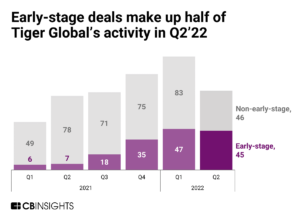

CB Insights shared the fact that some of the larger venture firms, who also happen to do most of their work in large and later stage rounds, are being forced to move earlier in the cycle.

Tiger Global, the top investor in Q2’22, made a dramatic swing this year as just shy of 50% of its deals went to seed/Series A companies in Q2’22. “By comparison a year ago, in Q2’21, only 8% of its deals were early-stage rounds.”

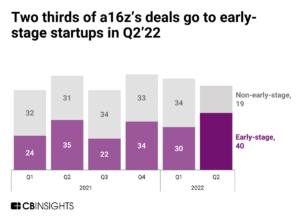

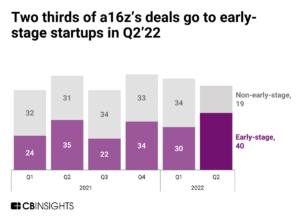

The story is pretty similar for famed Andreesen Horowitz. The majority (68%) of its deals in Q2’22 went to early-stage companies.

Bear in mind, these firms are largely focused on Tech not healthcare. That said, the trends are as we have laid out for months. Early stage investing has been brisk, and will continue to be brisk. Its actually being further fueled by larger firms having to deploy capital earlier in the chain.

The story is pretty similar for famed Andreesen Horowitz. The majority (68%) of its deals in Q2’22 went to early-stage companies.

Bear in mind, these firms are largely focused on Tech not healthcare. That said, the trends are as we have laid out for months. Early stage investing has been brisk, and will continue to be brisk. Its actually being further fueled by larger firms having to deploy capital earlier in the chain.