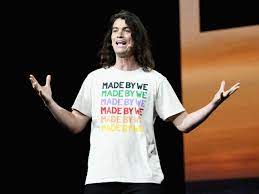

The We Work revisited story continues to get commentary given the massive investment made by Andreesen Horowitz. It’s true that Adam Neuman built a game-changing real estate business. They re-defined co-working spaces when the only real player had been sleepy Regus. They also raised extraordinary amounts of capital and convinced smart investors to value the… Continue reading Made By We (“Fail Big” Cont.)

Made By We (“Fail Big” Cont.)