Managed Syndicates: The Better Mousetrap

Most if not all investors understand Mutual Funds. Give money to a manager and they allocate that to a portfolio of stock or other assets. The manager charges a management fee typically from 0.5% to 2.5% per year and investors trust them to make good allocation decisions. Of course on average all investors together receive the average market return less execution fees, management fees and taxes. One way to go is with Exchange Traded Funds (ETF’s) . They have lower fees, less tax exposure and basically guarantee an average market return for that index, strategy or sector. The explosion in ETF’s shows both their popularity and their Achilles’ heel, namely that for all of their infinite variety they are still passive vehicles.

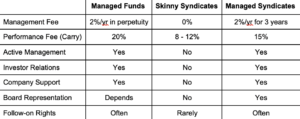

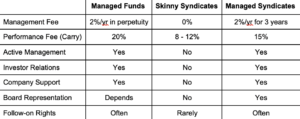

Hedge Funds by comparison are actively managed pools of assets. The managers attempt to achieve above market returns by dynamically choosing the best allocation of their Assets Under Management (AUM). In return they often charge 2 & 20. That is a 2%/yr management fee and 20% of the performance; this acts as an incentive to aggressively pursue the best opportunities available. Private Equity funds typically charge fees like Hedge Funds but while Hedge Funds mark their portfolio to market daily and thus can charge their performance fee at each year end, Private Equity is invested in illiquid assets and they receive their performance fee only upon successful “exits”.

Classic SPV’s or “Skinny” Syndicates as we will refer to them from now on are 1/2 way between the two on fees. They typically charge ~1.50% up front as an administrative expense and an 8-12% Carry which is paid to the organizer, GP and Lead Partner as incentive for creating and managing the entity in the names of all investors. Maybe you can already see the problems.

First, the admin fee on a small pool of capital is insufficient to support much more than tax filing responsibilities, as a result most skinny syndicate investors will rarely if ever hear from the company and tax documents are often late or missed entirely. Since the fee is a one time charge, the pool of funds shrinks every year and therefore must be hoarded to ensure it will outlast the syndicate.

Second, there is no portfolio management funding to support a PM. We know from experience that a strong support network can greatly enhance the successful outcomes of early stage investment. Apple does not need your help to sell iPhones but an early stage medical company definitely needs help from influential clinicians as Key Opinion Leaders, early adopters and business advisors.

Finally, individual investors have little representation or engagement with the investment itself. By investing at an arm’s length distance in many ways the SPV becomes a “fire and Forget” exercise. Theoretically the investor pool has every incentive to actively support the company. In reality it quickly becomes somebody else’s problem and they become disaffected or potentially ignored over time.

Managed Syndicates “Square the circle” by utilizing the AngelMD Expert network to do what it does best: Source, Select and Support the best investment opportunities in early stage health care. We charge a 2% management fee, but only for the first three years. Those are the years where our influence may provide the most benefit to the company. Our Annual Administration fee of 0.40%/year ensures we have an administrative wrapper in place to support investor relations and other legal requirements without the risk of running the well dry.

The fee structure is simple, it is the operational structure and our capable and engaged expert network that really make this work. Rather than requiring our Portfolio Management team to become experts in all things dealing with catheters, we place one of our Clinical Advisory Board Members with existing expertise in the specialty to consult with the company as a Director, Advisor or Board Observer. This allows us to scale our support network while maintaining an aggressive overall fee structure when compared with other managed investments. To learn more about our Managed Syndicates structure and the pipeline of active and future deals fill out

this short form and we will contact you.

(If you are a startup seeking funding structure assistance you can use the same form.)

You get what you pay for, but don’t pay “Retail”

Note that I did not discuss follow-on investment rights. Let’s put a pin in that to discuss in a masters level forum and we’ll be building some new courses for AngelMD Academy.